The US payments ecosystem is in the midst of a shift toward mobile, and countless new and old stakeholders are attempting to accelerate this migra

The US payments ecosystem is in the midst of a shift toward mobile, and countless new and old stakeholders are attempting to accelerate this migration, which is moving at a glacial pace relative to other markets globally. But mobile payments can rise to the mainstream. For companies seeking to build out a robust mobile payments product, China’s thriving mobile payments ecosystem offers some insight — and some lessons.

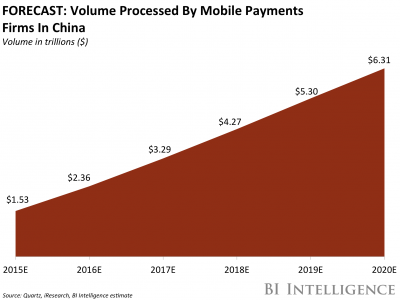

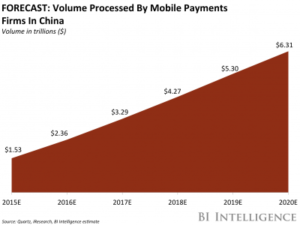

Total mobile payments volume in China will reach $6.3 trillion by 2020, according to our estimates based on iResearch data. This marks a healthy 33% five-year compound annual growth rate (CAGR). In comparison, the US will generate $154 billion in mobile payments volume this year by our estimates, which amounts to just 6.5% of China’s mobile payments volume.

Even accounting for population discrepancies, China will generate over $1,700 in mobile payments volume per capita in 2016, compared with $475 in the US, based on forecasts from BI Intelligence and eMarketer. China’s advantage will eventually diminish, but it will still produce around twice as much volume per capita in 2020.

China has unique factors buoying the industry, like the dominance of mobile phones, a lack of legacy infrastructure, and the surging popularity of digital retail marketplaces. Some of the characteristics behind the country’s success can be mimicked, or even replicated to some extent, in other markets like the US. However, one fundamental barrier in the US is that it’s being forced to layer mobile payments on top of an existing payments system, and the ecosystem is very fragmented.

A new report from BI Intelligence takes a deep dive into China’s mobile payments ecosystem and deciphers which growth drivers can be exported to the US to help spark its relatively lackluster market.

Here are some of the key takeaways:

- China claims the world’s largest mobile payments market and serves as the global benchmark for other markets to pursue. China will process a whopping $6.3 trillion in total mobile payments by 2020, according to our estimates based on iResearch data. This marks a healthy 33% five-year compound annual growth rate (CAGR).

- It dwarfs the US’ mobile payments industry. The US will generate $154 billion in mobile payments volume this year by our estimates, which equates to just 6.5% of China’s mobile payments volume. Meanwhile, China will generate over $1,700 in mobile payments volume per capita in 2016, compared with $475 in the US, based on forecasts from BI Intelligence and eMarketer.

- Mobile commerce, a lack of legacy infrastructure, and marketplaces have fueled China’s enormous success. Consumers in China are much more comfortable shopping on their mobile phones compared with their counterparts in the US, and the devices face less resistance from other legacy payments methods like credit cards. The open approach to mobile shopping has been fortified by Alibaba, a Goliath-sized marketplace, and WeChat, a go-to messaging platform, which support Alipay and Tenpay, respectively.

In full, the report:

- Forecasts and compares mobile payments volume, in-store mobile payments users, mobile payments volume per capita, and mobile commerce penetration in China and the US.

- Overviews the key competitors in China’s mobile payments market, and how new entrants may shuffle the hierarchy of dominant players.

- Uncovers the key drivers propelling China’s mobile payments market.

- Identifies which drivers the US can import from China, and which barriers may be standing in the way.

businessinsider.com