The Arab Gulf has been always attracting attention due to its vast hydrocarbon reserves, geopolitical risks and investment worries or since lately new

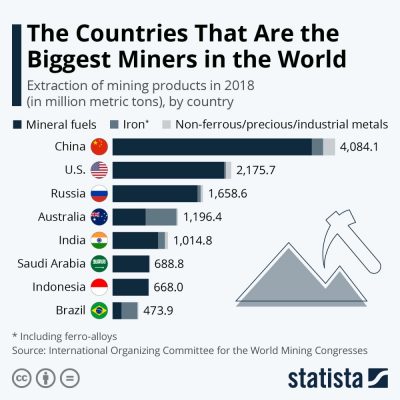

The Arab Gulf has been always attracting attention due to its vast hydrocarbon reserves, geopolitical risks and investment worries or since lately new strategies with regards to economic diversification and energy transition issues. One major economic sector however has never been really getting the attention it deserves, but this could change dramatically if the results of the Saudi Future Mineral Forum 2022 in Riyadh the last days are going to materialize. Saudi Arabia, OPEC’s main kingpin, is set to target foreign direct investment (FDI) of around $130 billion to open up its mineral and metals reserves in Kingdom. To support the latter, as stated by Khalid Al Midafir, Saudi deputy minister of Industry and Mineral Resources, the Kingdom has issued already 9 mining permits with total investments of more than 30 billion Saudi riyals ($8 billion) since it began enforcing a landmark law to exploit its massive mineral resources in 2020. At present, the Kingdom has already granted 157 licenses for metal exploration out of 700 applications received by its new online mining investment platform. The statements of Al Midafir are supported by Saud Industry and Mineral Resources minister Bandar Al Khurayef who stated at the Future Mineral Forum (FMF) that the estimated wealth of the Kingdom’s mineral wealth at present is set at $1.3 trillion. Al Khurayyef already has reiterated, also as a reaction to FMF participants, that a new mining investment law to attract local and foreign capacity is being put in place. The Kingdom has set an impressive target in place to boost the local mining sector’s contribution to gross domestic product from an estimated $17 billion currently to $64 billion by the end of the Kingdom’s Vision 2030 economic scheme.

That the FMF is attracting immense international attention is also clear due to the facts shown that closed-door meetings at the Forum were attended by ministers from Saudi Arabia, Bahrain, Djibouti, Egypt, Iraq, Kenya, Kyrgyzstan, Kuwait, Morocco, Nigeria, Oman, Somalia, Sudan, Tunisia and Yemen, as well as high-level delegates from Algeria, Australia, China, France, Japan, Palestine, Pakistan, Mauritania, Qatar, the Russian Federation, South Africa, Tanzania, United Arab Emirates, United Kingdom, and the United States. Also participating are key officials from the Arab League, Development Partner Institute (DPI), Gulf Cooperation Council (GCC), International Council on Mining and Metals (ICMM), International Finance Corporation (IFC), Intergovernmental Forum on Mining, Minerals, Metals and Sustainable Development (IGF), International Renewable Energy Agency (IRENA), Organization for Economic Co-operation and Development (OECD), United Nations Environment Program (UNEP) and the World Bank.

The Saudi mining sector already is based on more than 1,290 factories producing mineral products in Saudi industrial cities, the Saudi Authority for Industrial Cities and Technology Zones, aka Modon, stated. The latter is largely based on the fact that Saudi Arabia boasts the largest mineral reserves in the Middle East. The kingdom is particularly rich in gold, silver, lead, and tin, among others, according to the Riyadh-based National Industrial Development Center.

Mining role in energy transition

The call to expand the Saudi mining sector production is also linked to the Kingdom’s drive to generate 50% or more of the Kingdom’s energy from renewable sources. To support this local demand for silica, copper and others will be increased substantially. Suliman Bin Khaled Al Mazroua, head of the National Industrial Development and Logistics Program (NIDLP) stated that downstream mining activities and industrialization is encouraged to satisfy the future needs of renewable energy. He also said laws and regulations in the Kingdom stimulate investments in the downstream mining sector, especially with the ongoing shift to renewable energy. The NIDLP official also indicated that copper is in short supply, while cobalt use needs to rise 13 times by 2040 to satisfy future needs of electric vehicles. Current production of EVs is around 3 million cars per year, but this is expected to go up to 71 million units in 2040. The organization is currently targeting a list of 10 minerals, including copper, gold, phosphate, silica and steel. To support mining investments in Kingdom, mining loans are now provided through the Saudi Industrial Development Fund with very low interest rates.

Licensing

This week, the Saudi Ministry of Industry and Minerals also stated it will auction exploration licenses to foreign investors for the first time. The sale will be for deposits of copper, zinc, gold, silver and lead about 200 kilometers from Riyadh, the capital. The area will need roughly 2 billion riyals ($530 million) of investment and contains an estimated 26 million tons of ore, which foreign investors would be given 100% ownership of, said Abdulrahman Al Belushi, general manager of the ministry’s mining strategy department.

At the end of 2021 Saudi Ministry of Industry stated to press that, in close cooperation with the Ministry of Finance, new regulations are being prepared to set up a mining fund to support the objectives of the comprehensive strategy for the mining industries. The new fund is going to be part of the Saudi National Industrial Development and Logistics Program to be implemented over 24 months from the end of the second quarter of 2021. The ministry indicated that the value of mining investments for 2020 is at SR3.9 billion ($1 billion), but should increase to SR115 billion ($30.6 billion) by 2025. In December 2021 the Ministry of Industry and Mineral Resources also reported that the Saudi Geological Survey (SGS) has launched the National Geological Database Initiative to enable potential investors and operators to receive and transfer data. The new database will entail “geological regional information”, targeting to make data available for investors in addition to data from maps and mining surveys, such as surface and digging samples.

During the FMF, the Ministry of Industry and Mineral Resources also stated that several new copper licenses are going to be auctioned at the end of 2022. This follows the licensing tender of the mineral-rich Al-Khunayqiyah site in southern Riyadh. Deputy minister Al Mudaifer said that “we have two other copper auctions coming up at the end of the year and then, hopefully, this will attract attention and work. We will do more in the same model or a different model of bringing licences to be auctioned”. The already tendered license for the mineral-rich Al-Khunayqiyah site in southern Riyadh is expected to counter Saudi demand for zinc, with a potential export volume still available. When asked about the overall potential of Saudi mining, he reiterated that the current valuations of reserves in Kingdom are based on estimates done between 1960-1997, and also 2017 prices. A main focus at present is also to strengthen the position of reserves such as bauxite – which is the basis for aluminum. Saudi estimates are that the total value of bauxite reserves at present is around $40 billion, but could with more investments jump to more than $400 billion. This value increase is linked to the fact that Saudi Arabia has put more emphasis on selling aluminum sheets, in contrast to bauxite. Global demand for aluminum is skyrocketing, mainly due to energy transition demand and EV manufacturing.

Future Threats?

The impact and future role of mining globally is at present under severe pressure, not only by climate activists but also due to growing influence of ESG/SDG related reporting requirements. However, the threats to mining are not going to diminish overall opportunities, as energy transition and carbon-free manufacturing has had a very positive impact on overall demand. As is shown already by skyrocketing commodity prices for conventional minerals and metals, in combination with increased exponential demand for critical minerals or metals, demand is expected to stay extremely strong. At present global supply is struggling to keep up with demand. As Al Mudaifer indicated at FMF, the mining industry will need to work on its image, not only to keep investments available to grow but also to have consumers and industry understand the critical role being played by strong and expanding mining companies worldwide. Saudi Arabia has already recognized the latter, partly due to its experiences within the oil, gas and chemicals sectors. Potential issues such as carbon emissions have been clearly addressed during FMF. As one of the speakers at FMF, Abdullah Al Abdulkarim, head of the Saudi state-owned Saline Water Conversion Corporation (SWCC), stated, cutting carbon emissions is a necessity to prepare for the future. SWCC even wants to go further than the 60% emissions cuts realized at present. At the same time, SWCC, running 32 plants in 17 locations, has been recognized by the Guinness World Records for setting a global record in reducing energy consumption in water desalination to 2.271 kWh per cubic meter. The latter is of importance to mining operators too, as the sector is not only energy but also water intensive. Taking SWCC options as examples, more positive traction can be generated.

The Saudi Ministry of Industry and Mineral Resources at present is pushing for these kind of changes and innovative projects, also targeting the Saudi mining sectors. The Kingdom has already enacted several laws and legislations in 2021 to achieve sustainable and continuous development in mining areas.

Ma’aden – Arabian Mining Corporation

One of the main Saudi drivers behind the total mining sector is clearly Arabian Mining Corporation, also known as Ma’aden, a top-ten player in the Saudi economy, growing extremely fast. As mining was identified by Saudi Vision 2030 in 2016 to be a new backbone of the country’s beyond-oil economic diversification plans, Ma’aden has been playing a major role. At present, the Saudi giant has a market cap topping SR100 billion ($26.9 billion). Even that the company has been largely focusing on minerals and metals, new plans have been published that state that it will start operations of the largest gold mine in the country in the Makkah region, on the western coast of the Arabian Peninsula in Q1 2022. Reports have indicated that the gold mine is expected to produce around 1 million ounces of gold per year by 2025. At the same time, Ma’aden is one of the three largest global phosphate fertilizer producers, supported by the pre-operational stage of the $900 million ammonia plant in Ras Al-Khair industrial city in mid-2021. The latter is the first project of its “Phosphate 3” portfolio expansion. The new plant will add around 1 milion tons of ammonia production, bringing total production at 3.3 million tons per year. Ma’aden also has major JVs, such as the $10.8 billion JV with US company Alcoa, or the 85% $140 million stake of Mauritius-based fertilizer company Meridian Group.

Saudi Vision 2030 – Mining Sector – Energy Transition

As Saudi Vision 2030 clearly identified the mining sector as a pillar of its economic diversification plans, the Future Minerals Forum is a clear podium to address and show opportunities and strategies to a global audience. With an audience of more than 2,000, 150 major global investors and 100 speakers, the Kingdom seeks to attract new investments and mobilize support for the development of the various geological assets identified across Africa, the Middle East and Asia. An understanding and insight into the Saudi capabilities and potential is still needed, as most investors and analysts see it still as the Kingdom of Oil. As a global commodity power house, Saudi Arabia seems also to understand that the global energy transition drive, away from fossil fuels, investing in cleaner energy, however also holds a major opportunity. Global demand for minerals and metals need to be met. For the global, but especially Saudi-based, mining operators this is a god-sent. Again, mining is the main motor for an industrial revolution, now called energy transition. In the 4th industrial revolution, the circle is almost round, as global markets are yearning for minerals, metals but especially critical minerals, such as lithium and cobalt, along with other base metals are set to boost the global mining sector in the coming year.

Commodity assessments also however have shown that the so-called “normal” or conventional metals, such as copper, iron or aluminum, are set for a commodity bullish market of unknown order. Becoming green means invest in mining. Iron ore, and even coal also look set to be beneficiaries of the battle against climate change, wind turbines use huge amounts of steel, which requires iron ore and coking coal. At the same time, connecting offshore windfarms to onshore grids puts copper on the target lists too. The International Monetary Fund (IMF) has even warned soaring prices for the earth’s minerals could wreck the world’s transition to greener energy.

With most of critical metals and minerals again in the hand of ‘difficult or interesting’ countries, global markets are diversifying their efforts to find new options of supply. International media already is worried about the fact that China currently controls the bulk of world supplies of lithium and rare earths. In 2019, the US imported 80 percent of its rare earth minerals from China, while Europe imported 98 percent. The need for new mines to open is clear. Saudi Arabia, or even some other Arab countries, such as Jordan, Egypt or Iraq, could take advantage.

Fonte: Linkedin.it